Managing cash flow is one of the most critical aspects of running a successful business. Cash flow refers to the amount of money flowing in and out of your business's bank account at any given time. It is essential to keep a healthy cash flow to ensure that your business can meet its financial obligations, pay its bills on time, and invest in future growth. This blog post will explore how to manage your cash flow like a pro by using an Accounts Receivable (A/R) dashboard.

Why Cash Flow is Vital for Your Business?

Cash flow is essential for the success of any business, regardless of size or industry. Without maintaining healthy cash flow, businesses can't survive for long. Cash flow management helps to avoid cash shortages, late payments, and missed opportunities. Managing your cash flow gives you the ability to pay your bills on time, invest in marketing, reward employees, and innovate - all of which help your business grow and thrive.

Discover the Benefits of Using an A/R Dashboard

An Accounts Receivable (A/R) dashboard helps you manage your cash flow more efficiently by providing real-time insights into your accounts receivable. It streamlines your cash flow management, allowing you to make informed decisions and plan wisely. Here are some of the benefits of using an A/R dashboard:

1. How an A/R Dashboard Streamlines Your Cash Flow Management

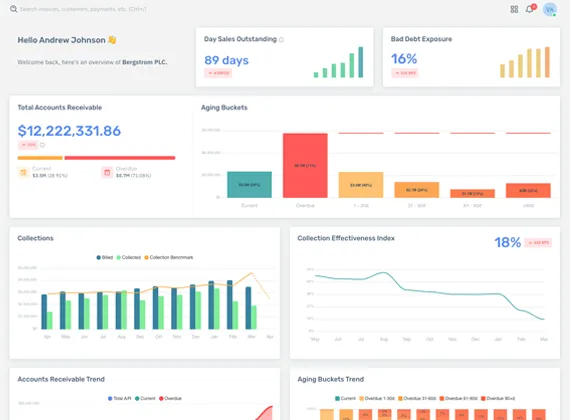

An A/R dashboard streamlines your cash flow management by taking away the guesswork. Instead of manually tracking your accounts receivable and aging, the dashboard presents a visual representation of your cash flow position at any given point in time. You can easily identify outstanding invoices, see when payments are coming due, and create reports that help you see the bigger picture.

2. Real-Time Insight into Your Accounts Receivable

An A/R dashboard gives you real-time insight into your accounts receivable, allowing you to see where your business stands financially. The dashboard tracks your outstanding invoices, alerts you to delinquent accounts, and provides data on average payment times. You can assess the cash flow situation and make timely decisions about how to allocate resources based on data rather than guesswork.

An example of DulyPaid's Real-time A/R Dashboard

Master the Art of Cash Flow Forecasting

One of the most powerful tools in a business’s arsenal is cash flow forecasting. It enables you to plan effectively and budget for future expenses and investments. Here are some ways to create accurate cash flow projections:

How to Create Accurate Cash Flow Projections?

Start by reviewing your current cash flow, making a list of your future expected income and expenses. Consider factors like sales trends, seasonality, outstanding invoices, and payment terms when forecasting for the future. Use these projections to set realistic budgets and make decisions regarding the best use of your resources.

Put Your Knowledge into Action for Improved Business Performance

With an A/R dashboard providing real-time insight into your accounts receivable and cash flow forecasting providing valuable information about your future expenses and income, it's time to put this knowledge into action. Here are some strategies you can implement for effective cash flow management:

Implement the Tools and Strategies for Effective Cash Flow Management

First, set clear payment policies and establish appropriate payment terms with your clients. Encourage prompt payments with incentives like early payment discounts, and follow up promptly on late payments with professional, yet firm, communications. Use digital tools and software that help streamline invoicing, payment processing, and account reconciliation. Finally, monitor your cash flow regularly, reviewing your A/R dashboard, and making necessary changes to your business strategies as needed.

Conclusion

Managing your cash flow is crucial for your business's success. By using an A/R dashboard, you can get real-time insights that streamline your cash flow management. Combining this with cash flow forecasting, you can gain advanced insights into future revenues and expenses. With the proper tools in place and strategies implemented, you can maintain a healthy cash flow and secure the future of your business. Remember to revisit your cash flow management strategies frequently, track your progress with an A/R dashboard, and adjust strategies based on data to keep your business moving forward.