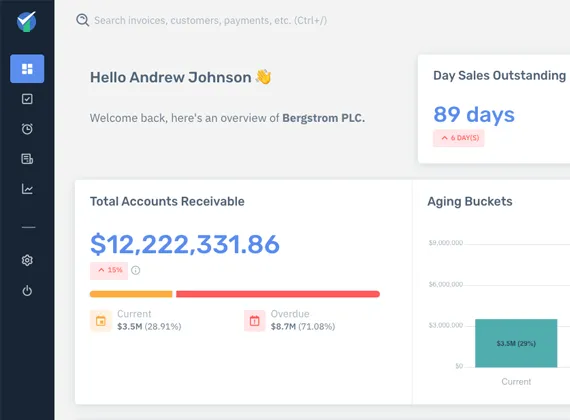

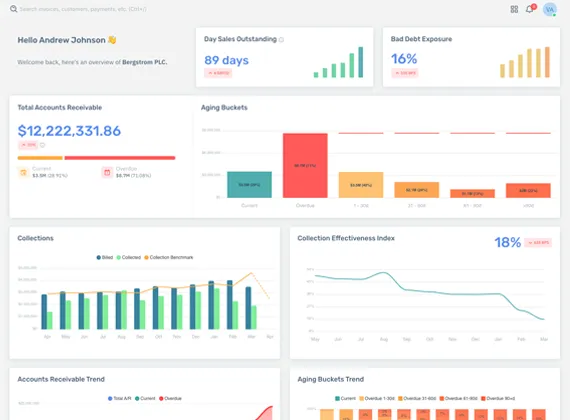

Automated & Real-time

Accounts Receivable Dashboard

Say Goodbye to manual reporting — get critical performance metrics instantly and reduce your DSO by 30%.

No more manual work, ever!

We automatically sync invoices from your Accounting Software and give you key A/R performance metrics instantly.

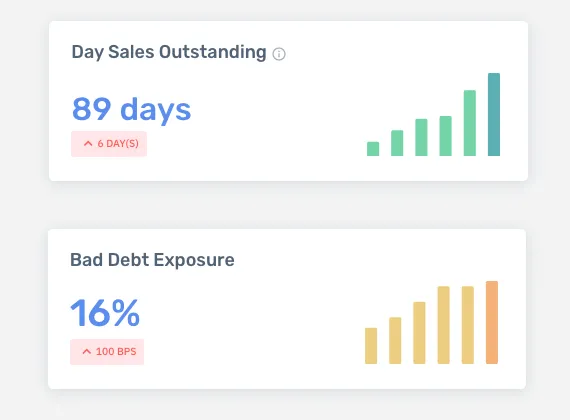

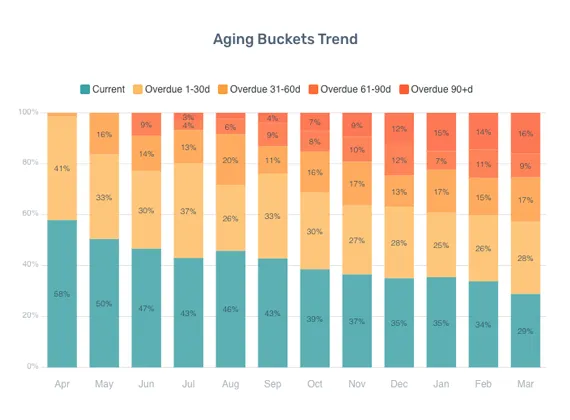

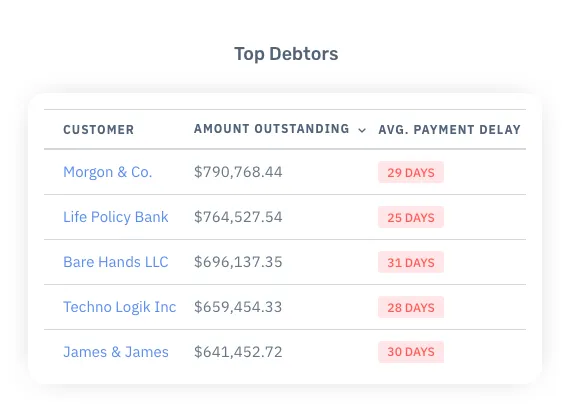

All key A/R metrics in one place, at once!

No more manual spreadsheet editing and error-prone calculations. Access all critical KPIs in one place — Aging Buckets, Collections, DSO, A/R breakdown, and many more.